25+ No closing cost refinance

Boost your credit. February 25 2022 - 9 min read.

2

H and R.

. On Sunday September 04 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed mortgage refinance. A minimum of 25 is required to open a US. This means that if your closing costs on the same loan were to equal 2500 the seller can only offer up.

Learn how you can refinance without closing costs and when it makes sense to do so. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Some lenders advertise no closing cost loans however this means these costs are rolled into the rate of interest on the loan.

Closing costs are usually paid by the buyer. This no-cost mortgage refinancing option can save you time and money. Or until you refinance to a conventional loan with 20 equity see PMI.

Lawyer Fee - 1000. Owners policy title insurance. Boydton Homeowners May Want to Refinance While Rates Are Low.

For a comprehensive list of account pricing terms and policies see the Consumer Pricing Information. Can closing costs be included in the loan. CBS News Live CBS News Chicago.

RCL the Company today announced that it has closed its private offering of 1250000000 aggregate principal amount of 11. Credit check fee. There are no prepayment penalties no application fees and no annual fees.

There are also no closing costs on loans from 2000 to 500000. Flexible terms and no closing costs 3 with a US. Homeowners who refinance can wind up paying more over time because of fees and closing costs a longer loan term or a higher interest rate that is tied to a no-cost mortgage.

Another no-closing-cost refinance method is to ask for lender credits. No minimum deposit needed to open Marcus by Goldman Sachs. How to lower the cost to refinance.

500 minimum deposit to open. News about political parties political campaigns world and international politics politics news headlines plus in-depth features and. A no closing cost loan is a bit of a misnomer.

To qualify tax return. Percentage of closing cost to home sale price. If your closing costs come to less than 3 of your loan value the seller can only contribute up to 100 of the closing cost value.

Lenders may refer to it as a no-cost refinance Financing your closing costs does not mean you avoid paying. Our calculator shows you the total cost of a loan expressed as the annual percentage rate or. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes.

Estimate your share of mortgage closing costs using this guide to 25 likely one-time and recurring fees for buyers. The choice of whether to get cash out when you refinance depends on your needs. No-closing-cost mortgages are still a suitable alternative for borrowers that.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Roll closing costs into your loan amount. For example the cost to refinance a 200000 mortgage may be between 4000 and 12000 while homeowners who have a.

Homeowners looking to refinance can. Offer period March 1 25 2018 at participating offices only. Credit report fees typically range from 25 50 depending on the lender and your state of residence.

What Are Todays Refinance Rates. Bank Personal Checking Package. That means the total cost will be dependent on the amount of the mortgage.

Closing costs are the total fees that are paid for the services required when you purchase a new home or refinance your existing home. 6 months 6 years 165 APY 325 APY. Discount Points 0.

Royal Caribbean Group announces closing of 125 billion senior unsecured notes offering to refinance near term debt maturities PRESS RELEASE PR Newswire Aug. 18 2022 PRNewswire -- Royal Caribbean Group NYSE. The increased Fed rate sitting at 225-25 following the July meeting will indirectly affect your rates.

Homeowners Insurance 1600. A no-closing-cost refinance lets you refinance without paying closing costs. Local News Weather.

6 months 5 years 165 APY 325 APY. Average closing costs in Texas. Second mortgages come in two main forms home equity loans and home equity lines of credit.

This limits your. 18 2022 0430 PM. And they typically cost around the same amount.

But while the federal funds rate determines what lenders base their rates on it is not. Its more accurate to call it a no upfront closing cost loan. Second mortgage types Lump sum.

Learn whether you can deduct closing cost after a home refinance with advice from the tax experts at HR Block. 25 or more. Refinance loans have closing costs just like home purchase loans.

Consider a no-closing cost refinance. Explore personal finance topics including credit cards investments identity. 500-1000 Title search and title insurance.

Best Refinance Offers 25 Years Of Experience As Reliable Second Mortgage Broker In Mississauga

Ways To Pay Off Your Mortgage Early And Why We Did It

Ways To Pay Off Your Mortgage Early And Why We Did It

2

Home Mortgage Refinancing Tips For A Smarter You

Defa14a

Why Would Anyone Buy A 5 Unit Rental Property Having To Pay 25 Down When They Can Just Buy A 4 Unit And Pay 5 Down Quora

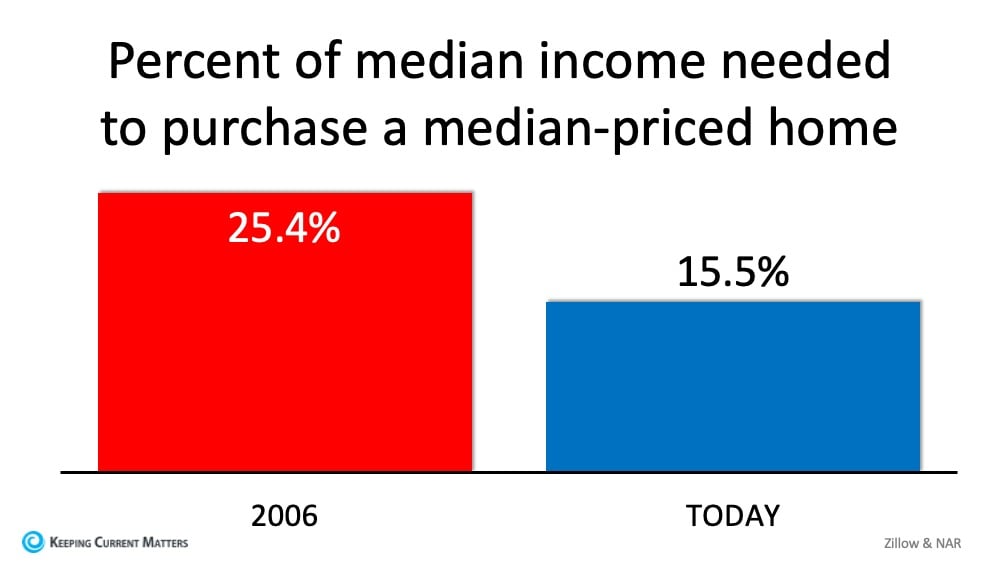

5 Simple Graphs Proving This Is Not Like The Last Time Keeping Current Matters

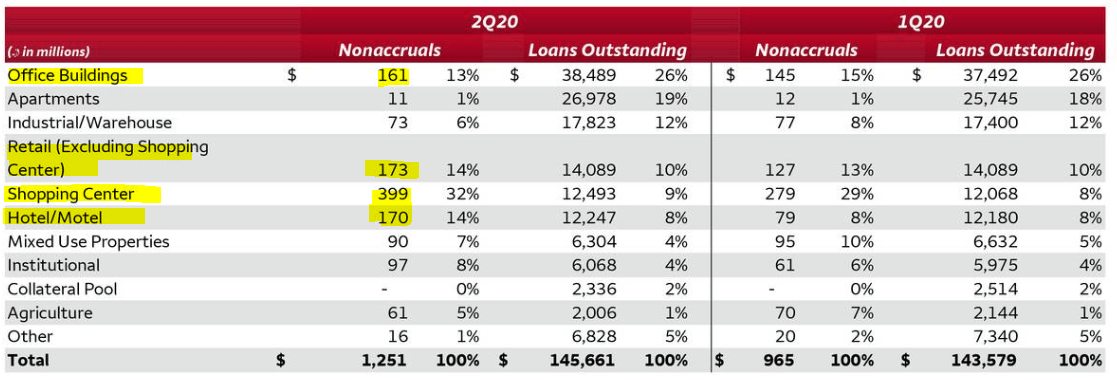

Capital Spotlight Eyzenberg Company

Defa14a

See Seven Major Factors That Effect Real Estate Appreciation Https Www Livegulfshor Real Estate Infographic Real Estate Information Getting Into Real Estate

1st Florida Lending I No Doc Hard Money Loans

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Why Would Anyone Buy A 5 Unit Rental Property Having To Pay 25 Down When They Can Just Buy A 4 Unit And Pay 5 Down Quora

Now Is Not The Time To Dump Wells Fargo Nyse Wfc Seeking Alpha

The Easiest Way To Shop For Mortgage Approvu

Looking For The Best Home Mortgage Lenders In Parker Discover Journey Home Lending